Amex Platinum Travel Credit Card Just Got Devalued - Here’s What Changed

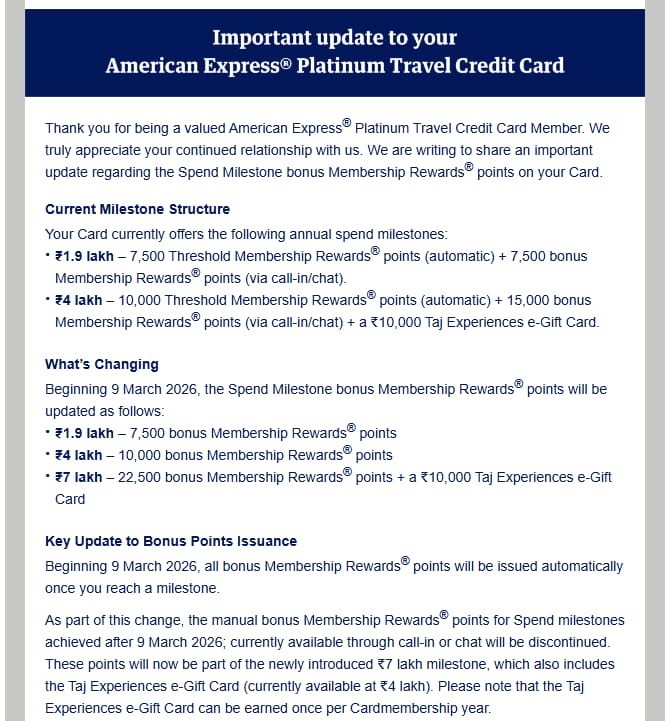

Effective March 9, American Express has revised the milestone rewards on the Platinum Travel Credit Card, and the update isn’t great news.

Amex Platinum card holders will now need to spend more to earn the same points, making the overall value proposition weaker than before. If Platinum Travel was part of your yearly milestone strategy, this change directly impacts your returns.

What’s Changed (New Milestone Rewards)

- ₹1.9L spend → 7,500 MR points

- ₹4L spend → 10,000 MR points

- ₹7L spend → 22,500 MR points + ₹10,000 Taj Voucher

Earlier Rewards (What You Used to Get)

- ₹1.9L spend → 15,000 MR points

- ₹4L spend → 25,000 MR points + ₹10,000 Taj Voucher

Earlier, ₹4L spend gave you most of the value.

Now, you’ll have to stretch your spends all the way to ₹7L just to get close to similar rewards.

Other Key Details

- - Annual fee remains the same at ₹5,000 + GST

- - Excluded categories spends will still count towards milestone spends

- - Rewards will now be auto-credited (no need to call customer care anymore)

- - Currently, Amex is not accepting new applications or invitations for the Platinum Travel Card, but this may start soon.

In short bonus points that you used to get via contacting the customer care have been removed and another layer of reward points are now unlocked by completing an additional milestone.

What You Should Do Now?

- Try completing your ₹4L milestone before March 9 to lock in the older credit card points and Taj voucher.

- If the card no longer fits your spending pattern, you can consider downgrading to MRCC. You may also be eligible for a pro-rata annual fee refund.

Other Credit Cards Undergoing Devaluation

This isn’t limited to just Amex. Several other credit cards have also revised their benefits recently.

For instance, Scapia was popular among solo travellers as it helped many users travel for free using reward points. However, it has now introduced higher spending limits and tighter conditions to unlock those benefits.

Similarly, ICICI Bank credit cards have seen multiple reward cuts, higher fees, and tighter conditions that can directly affect how cardholders plan their everyday spends.

You can read the detailed breakdowns here:

To stay updated with the latest information on credit cards, follow SaveSage blog. We share clear and detailed explanations that are easy to understand, whether you’re new to credit cards or hold multiple credit cards and want to optimise your rewards and benefits.